For sports professionals, choosing how to access luxury vehicles isn't just about getting from A to B – it's a strategic career decision that impacts your finances, flexibility, and professional image. With unpredictable contracts, potential transfers, and the need to maintain a premium lifestyle, athletes face unique challenges that traditional car buying advice simply doesn't address.

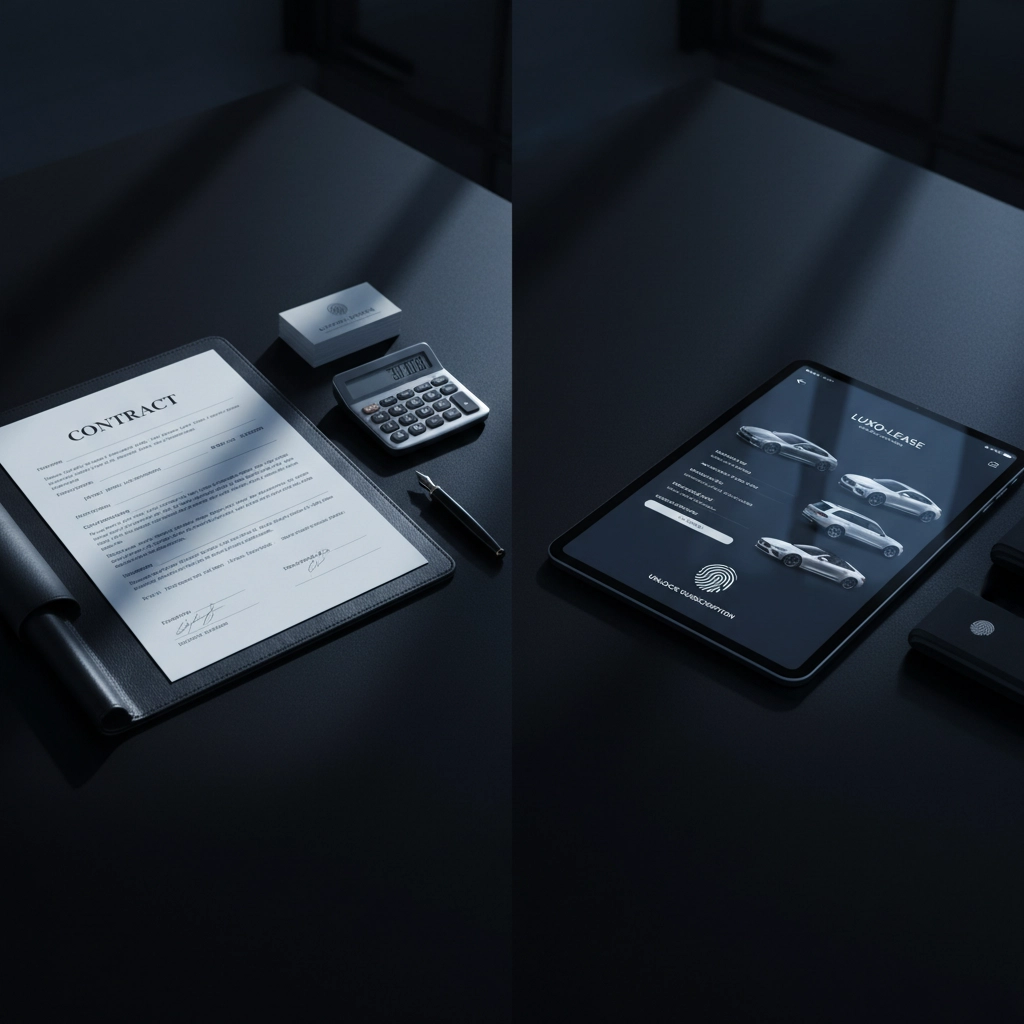

The question isn't whether you need access to high-end vehicles – it's how you get that access in the smartest way possible. Should you go the traditional route of finance and ownership, or embrace the flexibility that modern vehicle access programs offer? Let's break down both options so you can make the right choice for your career stage and circumstances.

Traditional car finance means taking out a loan to buy a vehicle outright. You'll typically put down a deposit (usually 10-20% of the vehicle's value), then make monthly payments over 3-7 years until you own the car completely. It's the route most people are familiar with, and it comes with some genuine advantages.

The biggest benefit is ownership. Once you've made that final payment, the vehicle is yours – no restrictions, no mileage limits, and you can modify it however you want. If you're someone who puts serious miles on a car or wants complete control over your vehicle, ownership makes sense.

From a financial perspective, you're building equity in an asset. While luxury cars do depreciate, you're not throwing money away entirely – there's always some residual value you can recoup when you decide to sell or trade up.

However, traditional finance comes with significant drawbacks that hit sports professionals particularly hard. The monthly payments are typically higher than other options because you're financing the entire vehicle cost. You're also taking on the full depreciation risk – luxury cars can lose 20-30% of their value in the first year alone.

Perhaps most importantly for athletes, traditional finance locks you into a long-term commitment. If you get transferred to another club, suffer an injury, or your contract situation changes, you're still tied to those monthly payments and the vehicle itself.

Flexible vehicle access covers everything from traditional leasing to modern car subscription services. These options have evolved significantly to meet the changing needs of high-net-worth individuals who value flexibility over ownership.

Traditional leasing lets you drive a new car for 2-4 years while only paying for the depreciation during that period. Your monthly payments are lower, and you can walk away at the end of the term with no worries about resale values or market fluctuations.

Car subscription services take this further. You pay a monthly fee that typically includes insurance, maintenance, and roadside assistance. Want to drive a Ferrari F8 Tributo for the summer season and switch to a Range Rover for winter? Many premium programs make this possible.

The financial advantages are compelling for sports professionals. Lower monthly costs mean better cash flow management – crucial when your income might be tied to performance bonuses or seasonal contracts. You're also protected from depreciation, which can be brutal in the luxury car segment.

More importantly, flexible access aligns with the realities of a sports career. Need to relocate for a transfer? No problem. Contract negotiations dragging on? You're not locked into payments for a depreciating asset. Injury sidelining you temporarily? Your vehicle costs can adjust accordingly.

Monthly Costs: Flexible access typically wins here. You're only paying for the vehicle's depreciation plus a profit margin, rather than the full purchase price plus interest. For a Lamborghini Urus Performante that might retail for £300,000, the difference in monthly costs can be substantial.

Long-term Value: Traditional finance has the edge if you plan to keep the vehicle for many years. While you'll face depreciation, you'll eventually own an asset. However, luxury vehicles rarely make financial sense as investments – they're lifestyle purchases.

Flexibility: This isn't even close – flexible access wins decisively. Whether it's changing vehicles, adjusting terms, or walking away entirely, modern access programs are designed around your changing needs rather than locking you in.

Maintenance and Hassles: Many flexible programs include maintenance, insurance, and even roadside assistance in the monthly fee. With traditional ownership, these are your responsibility and can add significant costs and inconvenience.

Professional Image: Both options can provide access to the same calibre of vehicles. However, flexible access often means you're driving newer models with the latest technology and features, which can actually enhance your professional image compared to owning an older luxury car.

Despite the advantages of flexible access, traditional finance isn't dead. It makes sense in specific scenarios that some sports professionals will find themselves in.

Choose traditional finance if you have a long-term, stable contract with one club or team. If you know you'll be in the same location for 4-5 years, ownership becomes more attractive. You'll also want to consider finance if you're a high-mileage driver – most lease programs cap you at 15,000-20,000 miles annually, and excess mileage charges can be expensive.

Some athletes prefer the psychological benefits of ownership. Knowing you own your vehicle outright can provide peace of mind, especially if you're naturally risk-averse or prefer tangible assets.

Finally, if you're someone who likes to modify vehicles or use them in ways that might violate lease terms (track days, for example), ownership gives you complete freedom.

For most sports professionals, flexible access aligns better with career realities. Choose this route if your contract situation is uncertain or you anticipate transfers. The ability to adjust your vehicle situation as your career evolves is invaluable.

Flexible access also makes sense if you want to minimize upfront costs and maintain liquidity. Rather than tying up £50,000-£100,000 in a deposit, you can keep that capital available for investments, property, or other opportunities.

If you value variety and want access to different vehicles for different purposes – perhaps a sports car for personal use and an SUV for family activities – flexible programs often make this possible within a single agreement.

International players should strongly consider flexible access. Managing vehicle ownership across different countries is complex and expensive, while many premium access programs have international partnerships or can arrange suitable vehicles wherever your career takes you.

Many successful athletes don't choose one approach exclusively. A hybrid strategy might involve financing one reliable vehicle for daily use while maintaining access to a flexible program for special occasions, different seasons, or specific needs.

For example, you might own a practical daily driver but access sports cars through a premium VIP program for events, holidays, or when you want to make a particular impression.

This approach balances the stability and equity-building of ownership with the flexibility and variety that modern access programs provide.

Your choice should align with your current career stage, contract stability, and personal preferences. Early in your career when contracts might be shorter and transfers more common, flexible access often makes more sense. As you establish yourself with longer-term contracts and more predictable income, traditional finance becomes more viable.

Consider your driving patterns, location stability, and what you value most – ownership and control, or flexibility and convenience. There's no universally right answer, but there is a right answer for your specific situation.

The key is treating this as a strategic career decision rather than an emotional purchase. Your vehicle acquisition strategy should support your professional goals and financial objectives, not work against them.

Whether you choose traditional finance, flexible access, or a hybrid approach, make sure you're working with specialists who understand the unique needs of sports professionals. The right partner will structure solutions around your career, not force you into standard programs designed for typical consumers.

Your vehicle is part of your professional toolkit – make sure you're accessing it in the smartest way possible for your current situation and future goals.